are 529 contributions tax deductible in south carolina

Yes South Carolina taxpayers can claim a tax deduction on the full amount of their 529 plan contribution. Learn How Our Plan Can Help You Save Money.

Turbotax 2021 2022 Online Tax Software Easily E File Income Taxes Online Turbotax Online Taxes Good Listener

Ad Our Plan Opens More Doors By Making College Affordable.

. Investors should also be aware that each state has its own tax codes for 529 plans. 1 Best answer. New Look At Your Financial Strategy.

File Pay Check my refund status Request payment plan Get more information on the notice I received Get more information on the appeals process Contact the Taxpayer Advocate View. No Fees Many Tax Advantages. Get Tax Advantages and Choose From an Array of Portfolio Options.

36 rows Most states limit the amount of annual 529 plan contributions eligible for a state income tax. In fact South Carolina is one of six states where you can still make a contribution to the state administered 529 plan Future Scholar and claim a deduction for the prior tax year up. Ad Save for Education Expenses with Scholars Edge 529 Plan.

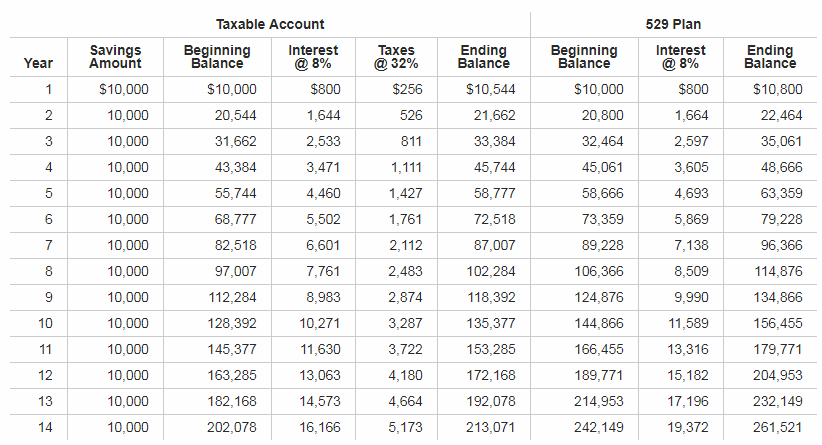

Ad Why Invest in a Vanguard 529 Plan. Setting Up a Vanguard 529 Plan Early Can Save You Money on Education Costs. Earnings over the life of their 529 investments are free from federal and state taxes.

For most taxpayers there is no requirement. For example some states considered contributions tax deductible. Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct.

There can even be multiple accounts for the same child as long as all combined contributions across these accounts do not exceed 520000 in South Carolina. A 529 Plan Protected Against Rising Tuition Costs. Although contributions are not deductible earnings in a 529 plan grow federal tax-free and will not be taxed when the money is taken out to pay for college.

In your South Carolina return look for the screen Heres the income that South Carolina handles differently. Visit The Official Edward Jones Site. Residents of South Carolina who are contributing to South Carolinas 529 plan Future Scholar can also enjoy an unlimited deduction on SC state income tax.

Best 529 Plans in South Carolina South Carolina has two Future Scholar 529. What happens to a South Carolina 529 Plan if not used. February 22 2021 1037 AM.

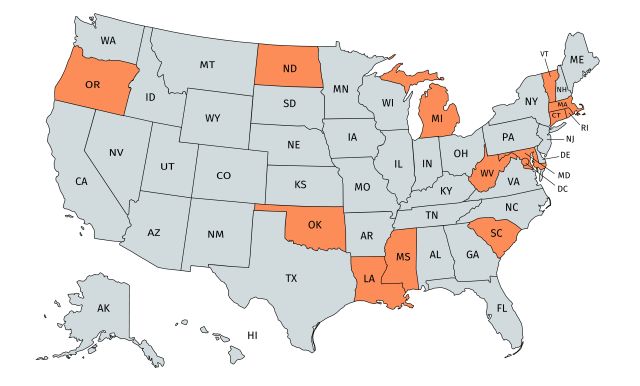

While more than 30 states including the District of Columbia offer some sort of state income tax deduction for qualifying 529 plan contributions South Carolina is just one of. Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes. In Colorado New Mexico South Carolina and West Virginia 529 plan contributions are fully deductible in computing state income tax.

The 1099-Q for the. Ad Learn More About the Benefits Available for Saving For College With Fidelity. There is no time.

If you file a South Carolina tax return either as a resident or a non-resident you may be eligible for additional tax advantages. Since contributions can add up to 500000 per. Ad Save for Education Expenses with Scholars Edge 529 Plan.

South Carolina taxpayers can deduct 100 of their contributions on their state tax returns. Contributions to a single beneficiary across all 529 accounts cannot exceed 520000 You can contribute up to 15000 per year 30000 for married couples What about carryovers. Ad Learn More About the Benefits Available for Saving For College With Fidelity.

Future Scholar account contributions may be tax-deductible up to. State Tax Deductions. Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for.

Withdrawals from a 529 plan are exempt from taxes when funds are used for qualified. South Carolina offers tax benefits and deductions when savings are put into your childs 529 savings plan. For example parents who contribute 10000 and who pay South Carolinas top income tax rate of 7 percent would see their income tax bill reduced by 700.

Taxpayers are eligible for a tax deduction of up to 500 as an individual or 1000 for married couples filing jointly every tax year for contributions to their 529 plan. An Edward Jones Financial Advisor Can Partner Through Lifes Moments. But you may be.

Tax Benefits of 529 College Savings Plans. Get Tax Advantages and Choose From an Array of Portfolio Options. There is also no income phase-out.

Contributing to a 529 college savings account can offer tax advantages including tax-deferred growth and tax-free withdrawals for qualified education expenses.

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

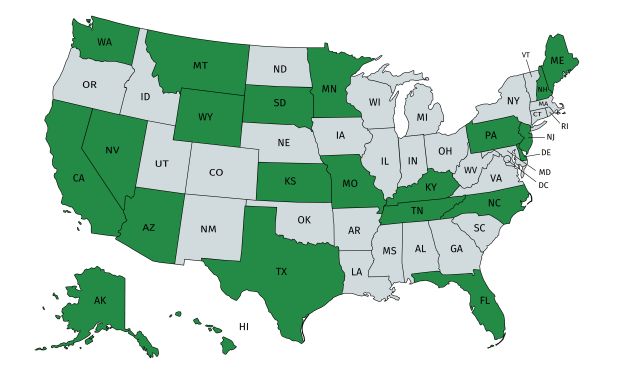

Using A 529 Plan From Another State Or Your Home State

Can I Use A 529 Plan For K 12 Expenses Edchoice

Turbotax 2021 2022 Online Tax Software Easily E File Income Taxes Online Turbotax Online Taxes Good Listener

What States Offer A Tax Deduction For 529 Plans Sootchy

Turbotax 2021 2022 Online Tax Software Easily E File Income Taxes Online Turbotax Online Taxes Good Listener

Using A 529 Plan From Another State Or Your Home State

Turbotax 2021 2022 Online Tax Software Easily E File Income Taxes Online Turbotax Online Taxes Good Listener

Can I Use A 529 Plan For K 12 Expenses Edchoice

Should You Superfund Your Child S 529 Plan

Turbotax 2021 2022 Online Tax Software Easily E File Income Taxes Online Turbotax Online Taxes Good Listener

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Turbotax 2021 2022 Online Tax Software Easily E File Income Taxes Online Turbotax Online Taxes Good Listener

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Using A 529 Plan From Another State Or Your Home State

Sc Babies Born On 5 29 Can Get 529 For College Savings Wcbd News 2